JACKSONVILLE, Fla. - Jan. 6, 2012 - The November Mortgage Monitor report released by Lender Processing Services, Inc. hows that while mortgage delinquencies at the end of November 2011 were nearly 25 percent less than the January 2010 peak, the trend toward fewer loans becoming delinquent, which dominated 2010 and the first quarter of 2011, appears to have halted. At the same time, new problem loans - those loans seriously delinquent as of the end of November that were current six months prior - have not improved significantly in the last year. This degree of stagnation indicates that while the situation is not getting markedly worse, it is not improving either, and inventories of troubled loans remain significantly higher than pre-crisis levels across the board.Here are a sampling of charts from the December 2011 Mortgage Performance Observations

click on any chart for sharper image

Delinquencies vs. Foreclosures

First Time Delinquencies Slowly Rising

Cures to Current Decline

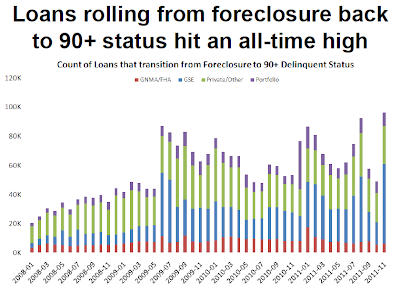

Foreclosures back to 90+ Days Delinquent

History suggests those rollbacks from foreclosure to 90+ days delinquent will soon be back in foreclosure and eventually REO (bank real estate owned).

Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List